Minimum Income To File Taxes 2024 In Illinois List

Minimum Income To File Taxes 2024 In Illinois List. University of illinois tax school is not responsible for any errors or omissions, or for the results obtained from the use of this information. For unmarried or legally separated individuals who qualify as heads of household:

Maximize efficiency with tips for faster refunds and avoid common filing mistakes. Distributions of interest, dividends, capital gains and other.

Keep Records For Seven Years If You File A Claim For A Loss From Worthless Securities Or Bad Debt Deduction.

Distributions of interest, dividends, capital gains and other.

Llc Tax Tips For Small Business Owners.

Check if you need to file:

If You Were 65 Or.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, All information in this site is provided. Keep records for seven years if you file a claim for a loss from worthless securities or bad debt deduction.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, January 15 of the following year. Distributions of interest, dividends, capital gains and other.

Source: www.chrisbanescu.com

Source: www.chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu, File as soon as possible to limit penalties. Sign up for access today.

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Check if you need to file: For the 2023 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs.

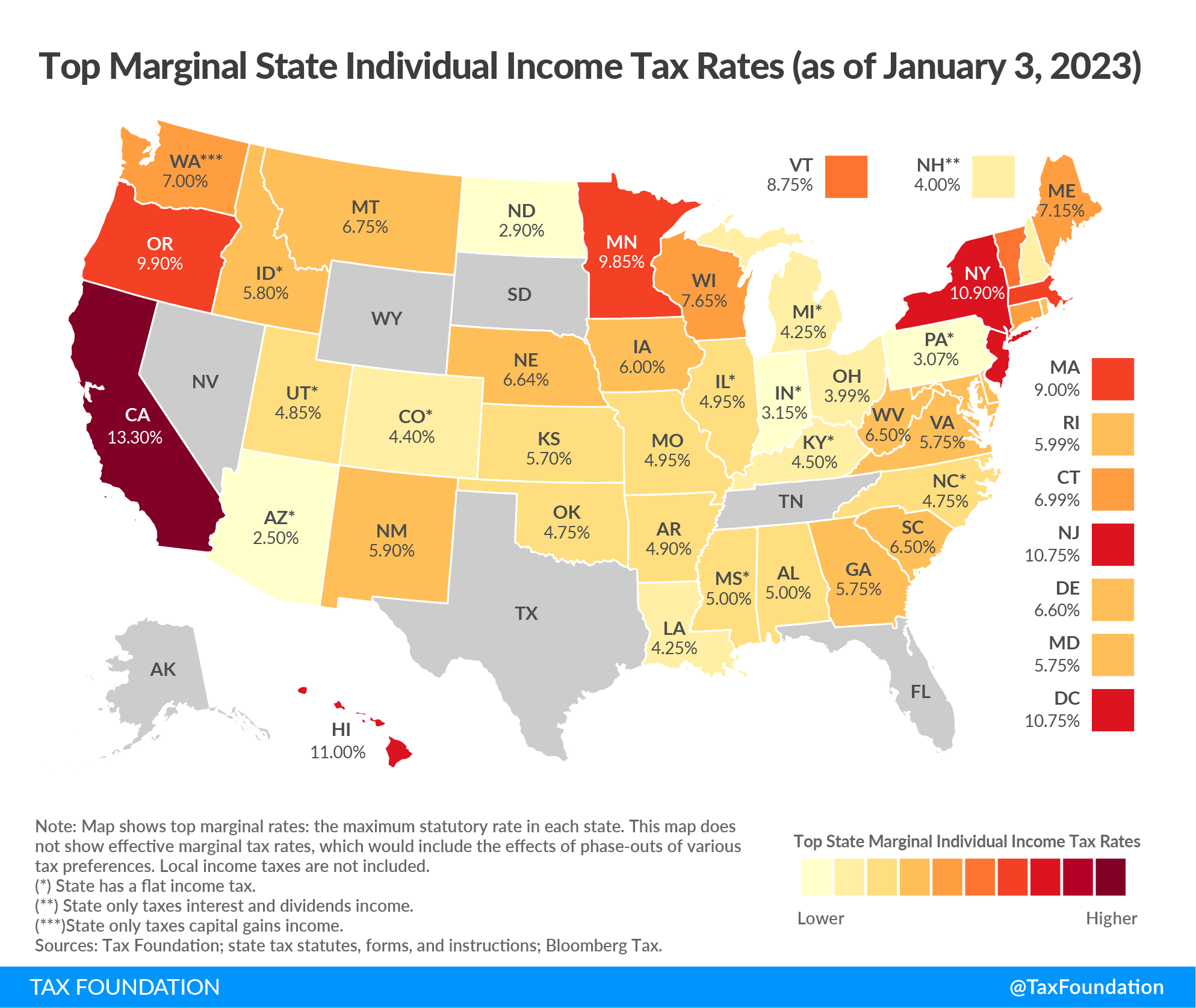

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, If you’re a dependent on someone else’s tax return. Subtractions except for social security income, retirement income, illinois income tax overpayment, military pay, u.s.

Source: guillemettewedna.pages.dev

Source: guillemettewedna.pages.dev

When Is The Soonest You Can File Taxes 2024 Sandy Cornelia, Minimum income to file taxes in 2024. Illinois provides a standard personal exemption tax deduction of $ 2,625.00 in 2024 per qualifying filer and qualifying dependent(s), this is used to reduce the amount of income.

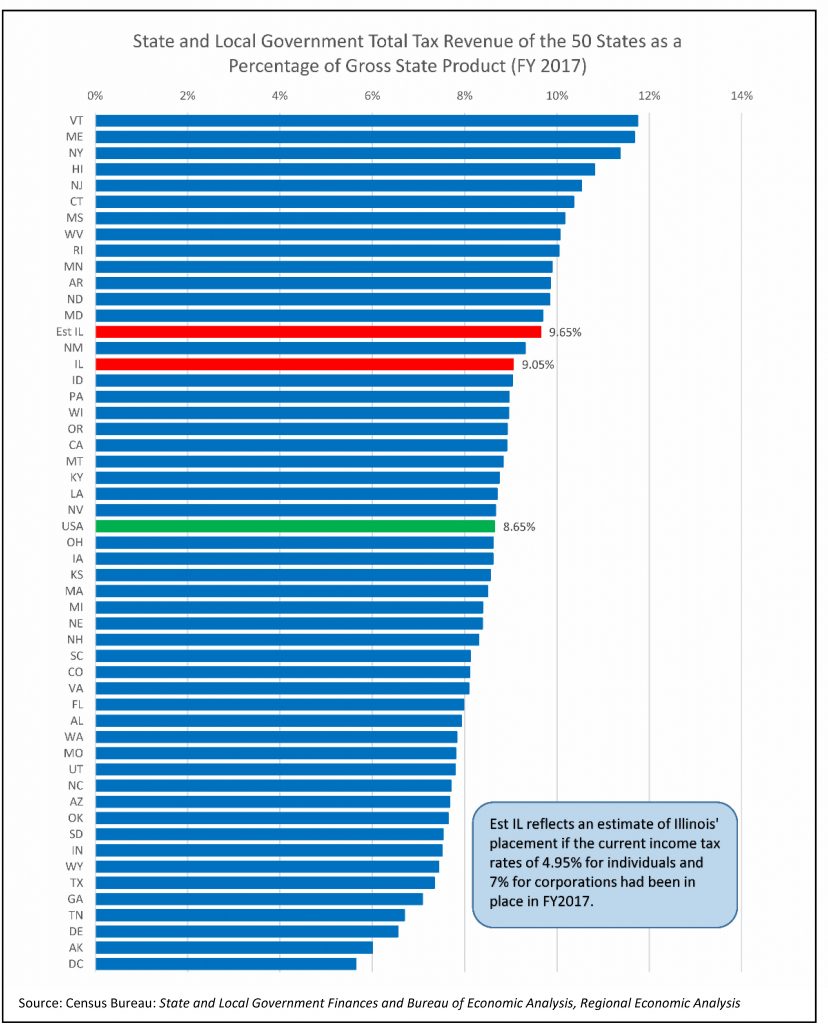

Source: www.illinoistax.org

Source: www.illinoistax.org

Taxpayers' Federation of Illinois Tax Facts An Illinois Chartbook, Check if you need to file: Driver charged with reckless homicide, dui in fatal crash of glenbrook south hs senior.

Source: www.jspartners.com.my

Source: www.jspartners.com.my

Step by Step Tax eFiling Guide, For unmarried or legally separated individuals who qualify as heads of household: For current year you can file your normal itr.

Source: margiewdaphna.pages.dev

Source: margiewdaphna.pages.dev

Tax Year For 2024 Jazmin Shandie, Minimum income to file taxes in 2024. Illinois, or the prairie state, offers a mix of rural and urban landscapes, as well.

Source: altheaqeleonora.pages.dev

Source: altheaqeleonora.pages.dev

When Can File For Taxes 2024 Sammy Angelina, Interest, contributions to a 529 plan such as “bright. Distributions of interest, dividends, capital gains and other.

Illinois, Or The Prairie State, Offers A Mix Of Rural And Urban Landscapes, As Well.

If you make $70,000 a year.

This Bulletin Is Written To Inform You Of Recent Changes;

For unmarried or legally separated individuals who qualify as heads of household: